Business in the Front, Blockchain in the Back

Will enterprises co-opt Ethereum, or will Ethereum eat the enterprise?

Forget Marvel movies. The collision of Ethereum and the financial establishment has to be the most ambitious crossover event in history.

On one side, you have the mutant offspring of Bitcoin, Ethereum, which sought to transcend its predecessor’s technical limitations while furthering the same core values of decentralization and openness. On the other side, you have the banks and large corporates, the very hierarchical and opaque organizations to whom cryptocurrency was conceived as a raised middle finger — yet who employed their own blockchain evangelists convinced of the technology’s transformative potential. T-shirts and hoodies versus heels and suits (though fewer and fewer ties these days, sadly). The protocol of Vitalik Buterin and Gavin Wood versus the protocols of compliance and HR.

And yet, over the course of the half-decade since the Ethereum blockchain went live, these two seemingly night-and-day communities have intermingled, subtly influencing each other.

At first, during the 2014-2016 crypto bear market, it seemed like the banks would just cherry-pick the tech features they found useful and discard the forbidden fruit of digital assets. Private and permissioned blockchains were the flavor of the month, attempting to capture the transparency and resiliency of cryptocurrency networks while locking out the non-KYC’d rabble and maintaining fealty to fiat.

These days the picture is more complicated. "Enterprise blockchain" has become a stale and almost laughable buzzword (like "B2B" in the waning days of the dot-com bubble), though serious work on such integrations continues with little fanfare. And cryptocurrency, while still perhaps risque, is no longer verboten in the C-suites.

In this issue of Ethereum at Five, my colleague Ian Allison takes stock of Ethereum’s inroads into the business world, both via private versions such as JPMorgan’s Quorum and (gasp) public-chain use cases. Meanwhile, Nate DiCamillo tells the story of ex-bankers now exploring the wilds of DeFi.

It may be as improbable as Norse gods, aliens and superheroes fighting on the same battlefield. But unlike a summer blockbuster, the bridging of the Ethereum and enterprise worlds is real.

Marc Hochstein, Executive Editor, CoinDesk

Today on CoinDesk Live

Ethereum’s Bankless Bankers – Wednesday, July 29, 4 p.m. ET

Speakers: Hayden Adams (Uniswap), Rune Christensen (MakerDAO), Robert Leshner (Compound), Will Foxley (CoinDesk)

Smart contracts were supposed to substitute signatures with software. These ideas have gone from science fiction to a $3.6 billion market, thanks to the boom in so-called decentralized finance (DeFi) built on Ethereum. An unlikely crew has emerged to lead this movement. We’ll talk with them about how we wound up with yield farming, liquidity mining and inventions still to come.

Join our Discord community to chat during CoinDesk Live.

How the EEA Made Ethereum Palatable to Big Business

By Ian Allison

Ethereum has attracted the attention of large companies for almost as long as it has been around. But it wasn’t until early 2017 that a formal business-focused consortium came into being: the Enterprise Ethereum Alliance (EEA).

The EEA created a concerted effort to get large corporates and tech providers on the same page when implementing private (or “permissioned”) versions of Ethereum technology. Thereafter, the EEA became a kind of standards organization for blockchain business, with one eye on a future state when the public blockchain might morph together with private implementations.

After all, company intranets gradually became part of the internet, or so blockchain believers will tell you.

“The EEA inspired huge organizations to think about solving long-bemoaned data coordination challenges in new ways,” said Amber Baldet, who led the team at JPMorgan that built the bank’s open-source Ethereum-based blockchain client, Quorum. “No matter what enterprise platforms look like in 15 years, there will be pieces that evolved from ‘industry coopetition’ conversations that never would have happened otherwise.”

Back in February 2017 when the EEA launched, Julio Faura, who was head of blockchain at Banco Santander at the time, volunteered to become the alliance’s founding chairman, a position he held until July 2018.

“A few of us just got together to try to make the technology a little bit more suitable for enterprise uses,” recalls Faura, now the CEO of blockchain-based payments company Adhara. “We were all doing our own rudimentary attempts to use the technology. But it wasn’t conceived for enterprise use – rather for trustless and public use – and was very far from being ready.”

Ethereal Bestiary

By Doreen Wang

In late 2017, a new service to buy, breed and sell digital animals was so popular it overwhelmed the Ethereum blockchain. Developed by Axiom Zen, the oh-so-adorable CryptoKitties each have unique genomes, or codes, that define their appearance and traits.

They helped popularize and prove the value of digital assets known as non-fungible tokens (NFTs). By using the blockchain, CryptoKitties created something rare in the digital era: scarcity. Each kitty was one-of-a-kind and its true ownership could be verified.

But viral popularity and the high trading volume that followed clogged the network like never before. The CryptoKitties craze was a defining moment in Ethereum development that laid bare the network’s scalability limitations and demonstrated the need for Eth 2.0.

Why DeFi on Ethereum Is Like Algorithmic Trading in the ‘90s

By Nathan DiCamillo

Mona El Isa would never go back to traditional finance.

The former Goldman Sachs vice president developed the Melon protocol, a vehicle for creating Ethereum-based hedge funds without having to spend the tens of thousands of dollars it would take to launch a fund in traditional markets.

“Managers who are used to a fund custodian and fund administrator are starting to experiment with automating technology and DeFi,” El Isa said.

El Isa admits that not many founders in the decentralized finance space have her background in traditional capital markets. In the traditional world, DeFi resembles what algorithmic trading was in the ‘90s, said Tarun Chitra, CEO of Gauntlet Network, a business that does stress-tests on blockchain networks and DeFi platforms.

“A lot of money was made on random equities on electronic exchanges,” Chitra said of the Clinton-era innovation. “They were people who were more technical than financial.”

Now Ethereum’s surging DeFi sector could force a similar migration.

Blast From the Past

By Christie Harkin

Remember when Vitalik joined in the chorus at the end of Devcon 4 to sing about the different things that Ethereum failed to pull off? Yeah, some stuff just “didn’t work.”

Today I Learned

“The vending machine is a contract with bearer,” Nick Szabo wrote in a 1997 proposal to take the concept digital. “Anybody with coins can participate in an exchange with the vendor.”

Ethereum History in 5 Charts

Part 3: Testing the Limits

By Christine Kim and Shuai Hao

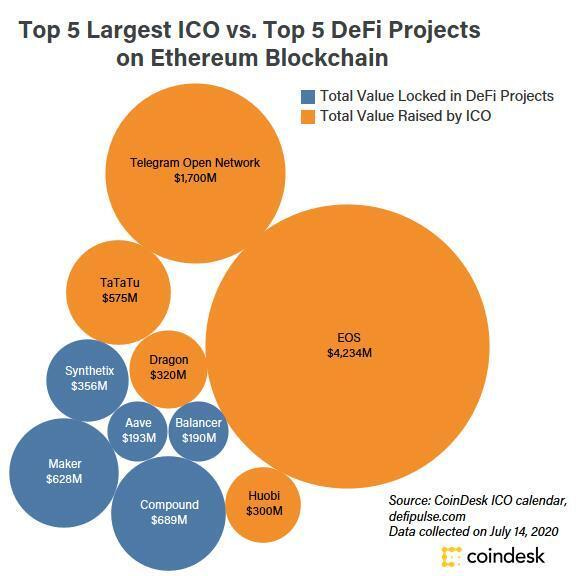

The need for Ethereum 2.0 and its expected benefits to network efficiency, as well as scalability, has only grown stronger since the CryptoKitties craze of 2017. The popularity of initial coin offerings (ICOs) – a way to crowdfund early stages of a cryptocurrency project – by dollar amount raised reached its peak in 2018. A total of $7.8 billion was raised for over 1,000 projects that year. According to ICObench, over 80% of all ICOs rely on the Ethereum blockchain to create their tokens and issue them to investors.

Trends like the ICO boom of 2018 are indicative of the ways blockchain technology can be leveraged in more ways than simply peer-to-peer electronic cash. Ethereum, as the world’s first general-purpose blockchain platform, has become the central hub where dapp developers congregate to build any and all types of use cases for blockchain, be it gaming- or finance-related.

As a result, despite the technical limitations of the platform, dapp developer activity on Ethereum continues to thrive. The latest trend dominating user traffic and transaction volume on Ethereum is decentralized finance (DeFi). The DeFi movement currently sweeping Ethereum is made up of dapps modeled after traditional financial players such as lending services, exchanges and derivatives markets. As of July 29, 2020, $3.68 billion worth of crypto assets are locked by users into various DeFi protocols.

Next in Ethereum History: Dapp Dominance…

Did you enjoy this email?

This newsletter was brought to you by CoinDesk editors Christie Harkin, Marc Hochstein, Elaine Ramirez and Zack Seward.

Get in touch at social@coindesk.com or reply to this email. Send to a friend: